- Markets are pricing in a 96% probability of a 25 bp rate cut, bringing the target range to 3.75–4.00%.

- The Fed is expected to end its QT program in November, after more than two years of balance sheet reduction.

- Chair Powell will likely emphasize “risk management” amid the lack of key macro data caused by the ongoing U.S. government shutdown.

- Swap markets price in nearly 87% odds of another 25 bp cut in December.

- Markets are pricing in a 96% probability of a 25 bp rate cut, bringing the target range to 3.75–4.00%.

- The Fed is expected to end its QT program in November, after more than two years of balance sheet reduction.

- Chair Powell will likely emphasize “risk management” amid the lack of key macro data caused by the ongoing U.S. government shutdown.

- Swap markets price in nearly 87% odds of another 25 bp cut in December.

Today’s Federal Reserve decision is expected to be a formality, as the market has fully priced in such a move. The Fed is set to cut rates by 25 basis points, but the key question is what comes next. The central bank has already received the September CPI report, which came in below expectations, though still above the Fed’s target.

Given the ongoing government shutdown, which will likely extend into November, the Fed will not receive October inflation or labor market data. This raises uncertainty over the economic outlook, but the shutdown itself is hurting workers and economic activity — a factor that could push the Fed toward another cut in December.

However, the tone of Powell’s remarks may not necessarily be overly dovish, especially if it hinges on the balance sheet decision.

Rate cuts — what next?

The Fed has made it clear that rate cuts will continue, a stance reinforced by the softer September CPI reading.

There was earlier speculation of a larger 50 bp cut, but this scenario is now mostly off the table — currently priced at just 3% probability. With the December meeting approaching, the likelihood of another 25 bp cut stands at nearly 90%.

This could change if Powell avoids a dovish tone during his remarks. On the other hand, the few hawkish voices within the FOMC mostly come from regional Fed presidents, who rotate among voting members. If Powell signals that the Fed needs more time and data confidence, this could lead to dollar strengthening and a correction on Wall Street.

Still, the Fed has an ace up its sleeve — one that could either accelerate current trends or deepen a correction.

Will the Fed end QT (balance sheet reduction)?

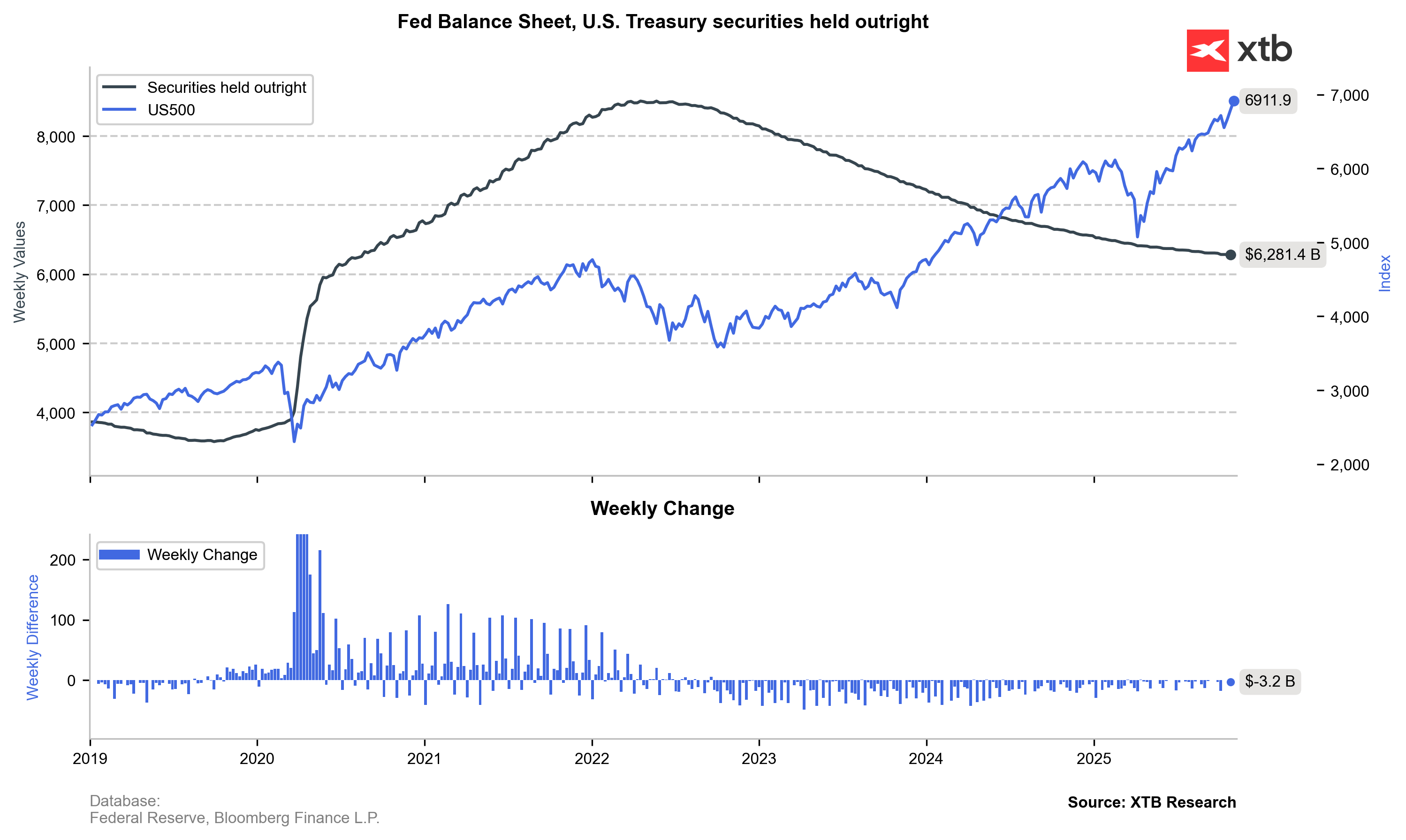

The Fed’s balance sheet is currently shrinking at a slow pace of $5 billion, and Powell has already hinted that the end of QT is near.

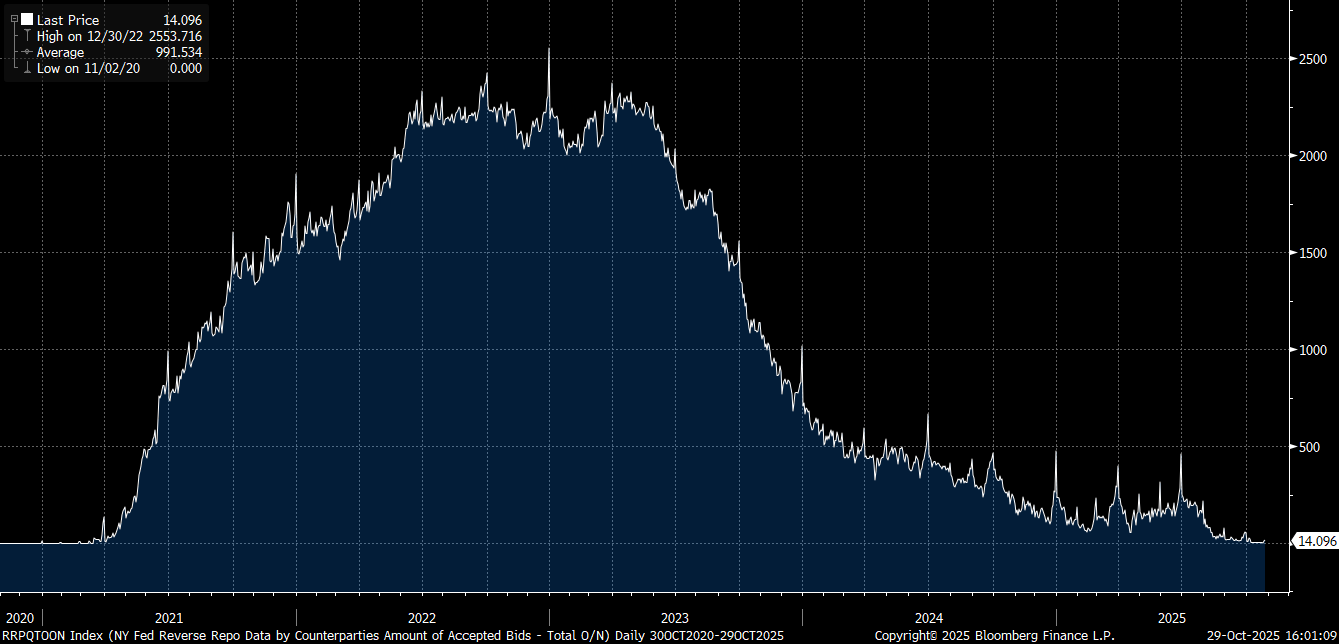

Moreover, several indicators suggest that system reserves have shifted from “ample” to merely “adequate.” The reverse repo facility has fallen to just a few billion dollars, implying virtually zero excess liquidity in the system.

While markets expect QT to end in December, there’s a strong chance Powell could announce its conclusion as early as November — which would be a major bullish catalyst for U.S. equities.

The reverse repo operations, which drain liquidity, have been minimal over the past three months, confirming tight financial conditions.

The Fed’s balance sheet has already been reduced by one-third, and overall system reserves have declined significantly. This could be a signal to end QT, which markets would likely view positively. In case of further economic deterioration, the Fed could swiftly restart asset purchases (QE), further lowering real interest rates.

Source: Bloomberg Finance L.P., XTB

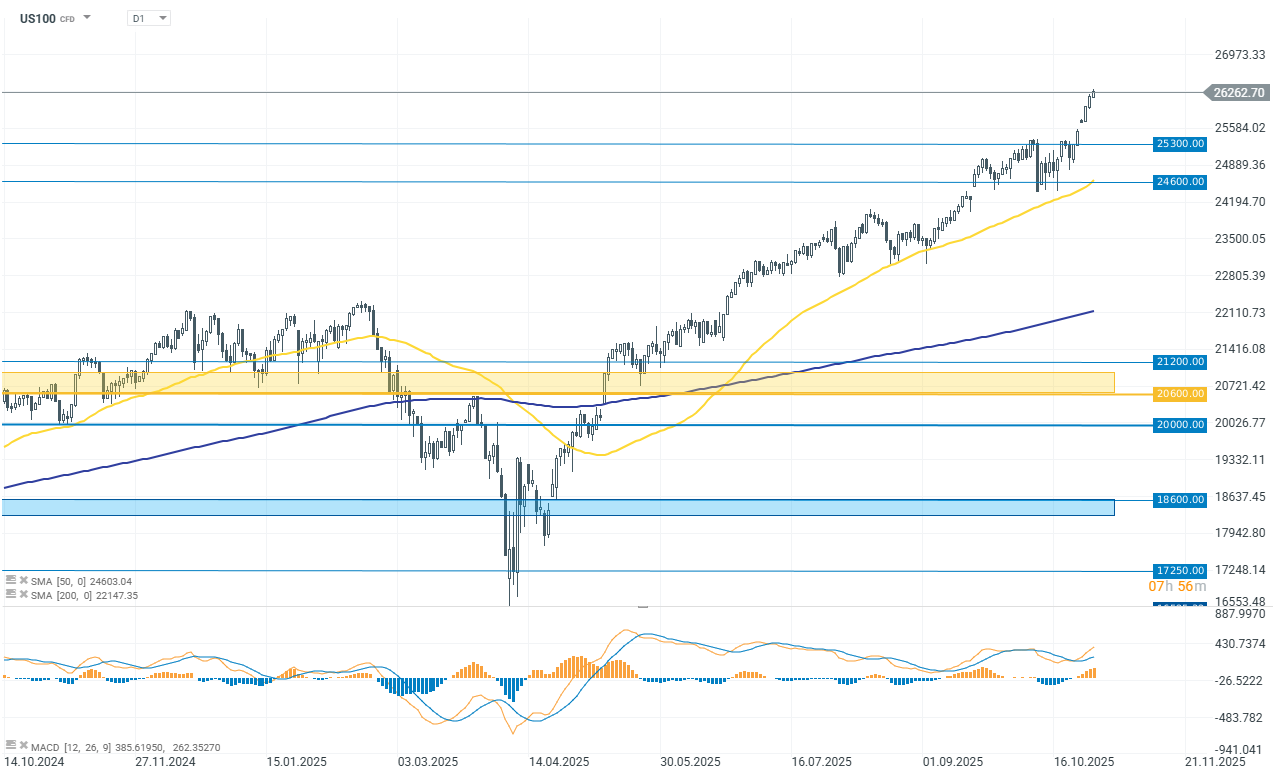

US100

The tech-heavy Nasdaq (US100) is up 0.34% ahead of the Fed decision, though gains have partly faded after opening more than 0.60% higher. The index remains at record highs, marking its third consecutive day of gains and up 2% for the week.

However, the market is currently playing with three key themes — today’s Fed decision is only one of them. Investors are also focusing on the corporate earnings season, which has so far delivered strong results, and the upcoming meeting between U.S. President Donald Trump and China’s President Xi Jinping.

Daily summary: Powell is pushing the dollar higher. Now it’s time for Big Tech earnings. 📄

EURUSD falls below 1.16 after Fed 💵

FED Powell Conference (LIVE)

BREAKING: Fed cuts interest rates and will end QT on December 1st 📌

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.