Textron (TXT.US), a US industrial conglomerate with a strong presence in the aircraft industry, is one of the best performing members of the Russell 1000 index today (index of 1000 biggest, public US companies). Stock trades 5% higher with NetJets deal driving the share price higher.

Textron announced that it has reached a fleet agreement with NetJets for an option to purchase up to 1,500 additional Cessna Citation business jets. Deliveries could be made over the next 15 years. To put this figure into context let us note that Cessna Citation is one of the largest families of business jets with more than 7,500 jets being delivered over the past 50 years!

The option is an extension of NetJets existing fleet agreement and while no financial details were disclosed it is said that it may be worth up to $30 billion over 15 years.

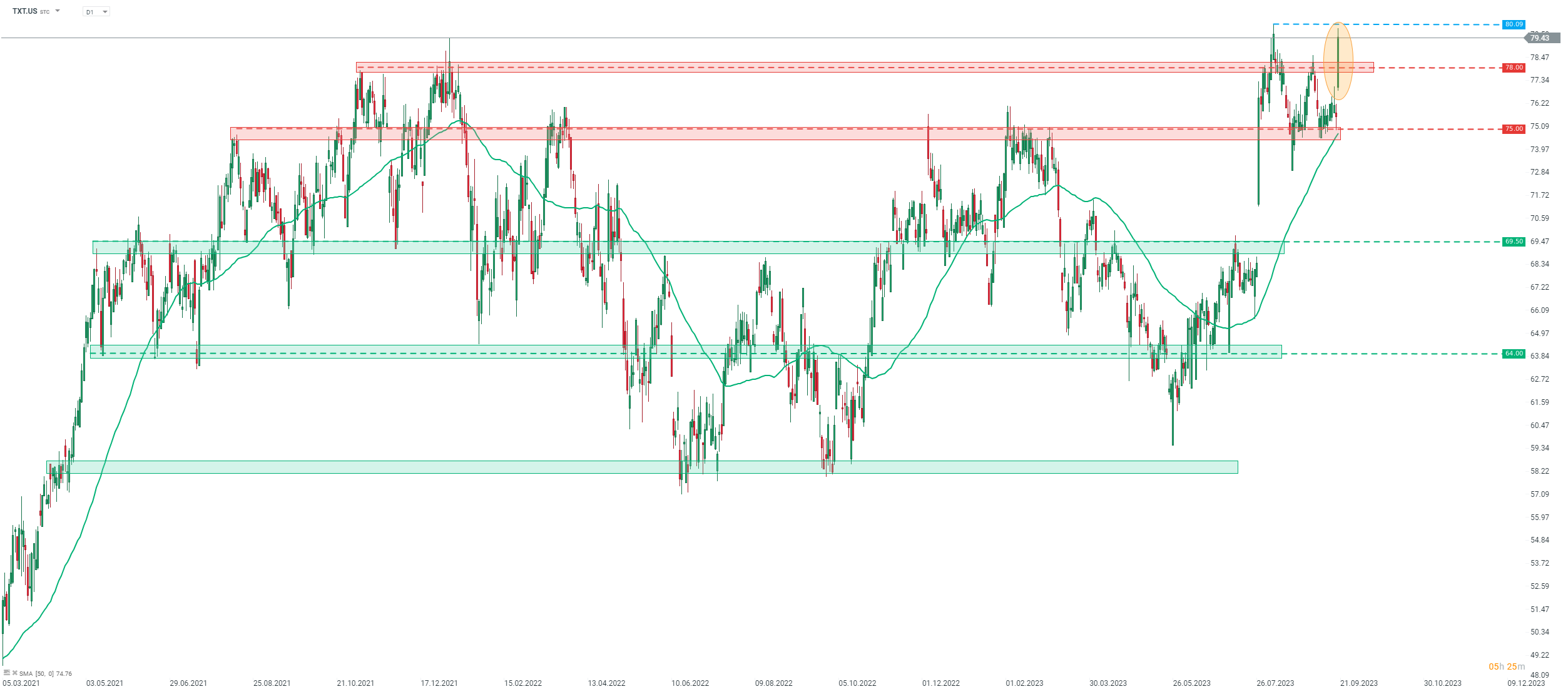

Taking a look at Textron (TXT.US) chart at D1 interval, we can see that the stock launched today's trading with a bullish price gap and continued to move higher during the session. Stock climbed above the $78 resistance zone marked with 2021 highs and is looking towards the $80 area where all-time highs can be found. A close above $79.60 would be the highest on the record for the stock!

Source: xStation5

Daily summary: Sentiments on Wall Street stall at the end of the week🗽US Dollar gains

AbbVie near 1-month low after earnings report 📉

Wall Street optimism tempers amid falling odds of December Fed rate cut

DE40: Decline of sentiment in Europe

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.