- Qualcomm shares jumped 20% after announcing AI200 and AI250 chips for data centers, targeting AI inference workloads.

- Chips offer low power consumption, high memory bandwidth and flexible deployment as individual units or full servers.

- Move puts Qualcomm in direct competition with Nvidia and AMD, supporting its strategy to diversify beyond smartphones and licensing revenue.

- Qualcomm shares jumped 20% after announcing AI200 and AI250 chips for data centers, targeting AI inference workloads.

- Chips offer low power consumption, high memory bandwidth and flexible deployment as individual units or full servers.

- Move puts Qualcomm in direct competition with Nvidia and AMD, supporting its strategy to diversify beyond smartphones and licensing revenue.

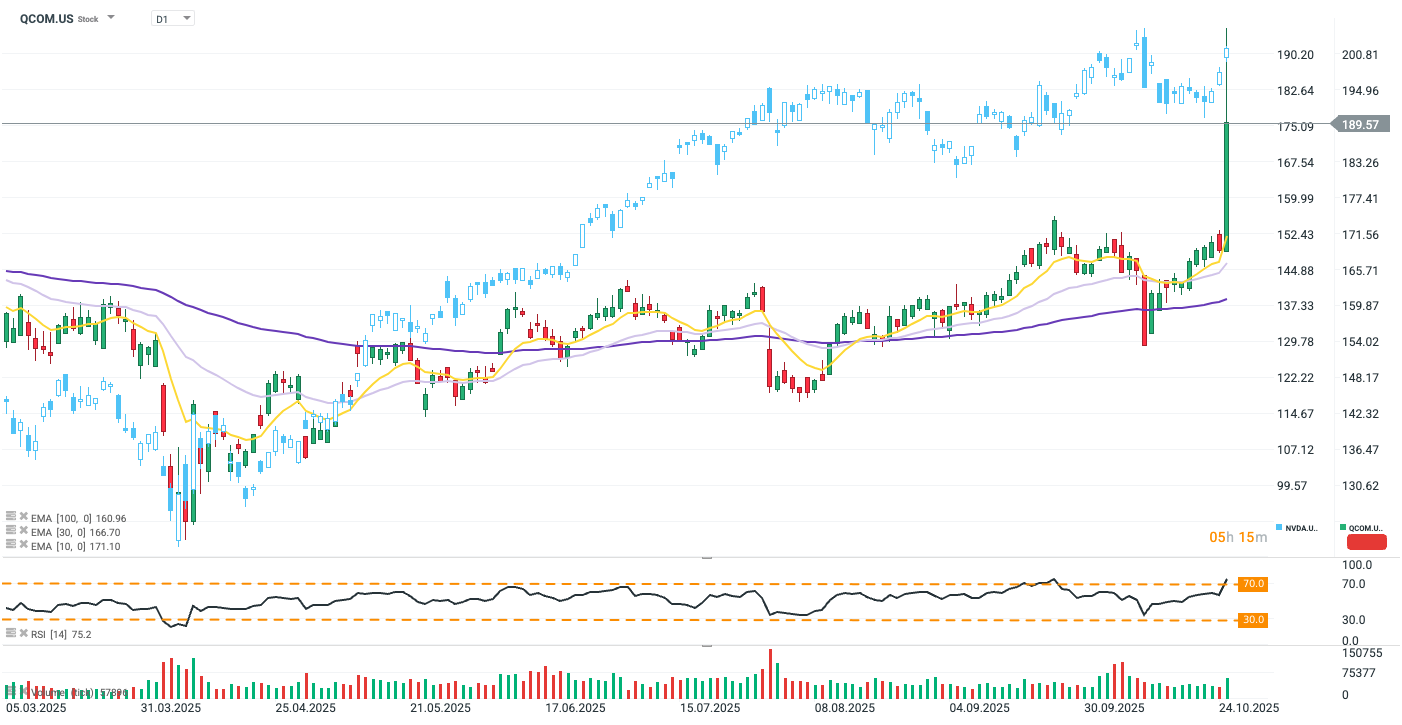

Qualcomm (QCOM.US) shares surged over 20% today after the company announced its entry into the data center market with the launch of new AI200 and AI250 chips, along with rack-scale server offerings. Nevertheless, Nvidia (NVDA.US : +2.5%) and AMD (AMD.US: +1.1%) keep trading in the green, as hopes for a US-China trade truce fuel optimism in the IT sector.

The AI200, launching in 2026, and the AI250, coming in 2027, leverage Qualcomm’s custom Hexagon NPU and are designed specifically for AI inference, offering low power consumption and competitive total cost of ownership. A third generation is planned for 2028, with the company aiming for an annual release cadence. The customers can access either the individual chips or full server setups.

Qualcomm’s move pits it directly against established players like Nvidia and AMD, though some customers could include these same rivals, highlighting potential partnerships as well as competition. It also represents Qualcomm’s broader strategy to diversify beyond its smartphone chip and licensing business. While the company has previously attempted data center ventures, including the Centriq 2400 platform with Microsoft, it now seeks a foothold in the multibillion-dollar AI server market dominated by Nvidia, AMD, and cloud giants.

Qualcomm shares hit their highest since July 2024. Source: xStation5

Daily Summary: CPI down, Markets Up

Procter & Gamble: After Earnings

"Mad Max" mode - Is Tesla in trouble?

Intel’s turnaround is showing results

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.