- Nvidia’s market capitalization is nearing $5 trillion, reaffirming its leading role in the global AI sector.

- President Trump’s remarks on talks with Xi Jinping about AI chip exports have raised hopes for easing U.S.–China trade restrictions.

- Surging demand for Blackwell processors and new research and supercomputing projects strengthen Nvidia’s position as a global innovation leader.

- Nvidia’s market capitalization is nearing $5 trillion, reaffirming its leading role in the global AI sector.

- President Trump’s remarks on talks with Xi Jinping about AI chip exports have raised hopes for easing U.S.–China trade restrictions.

- Surging demand for Blackwell processors and new research and supercomputing projects strengthen Nvidia’s position as a global innovation leader.

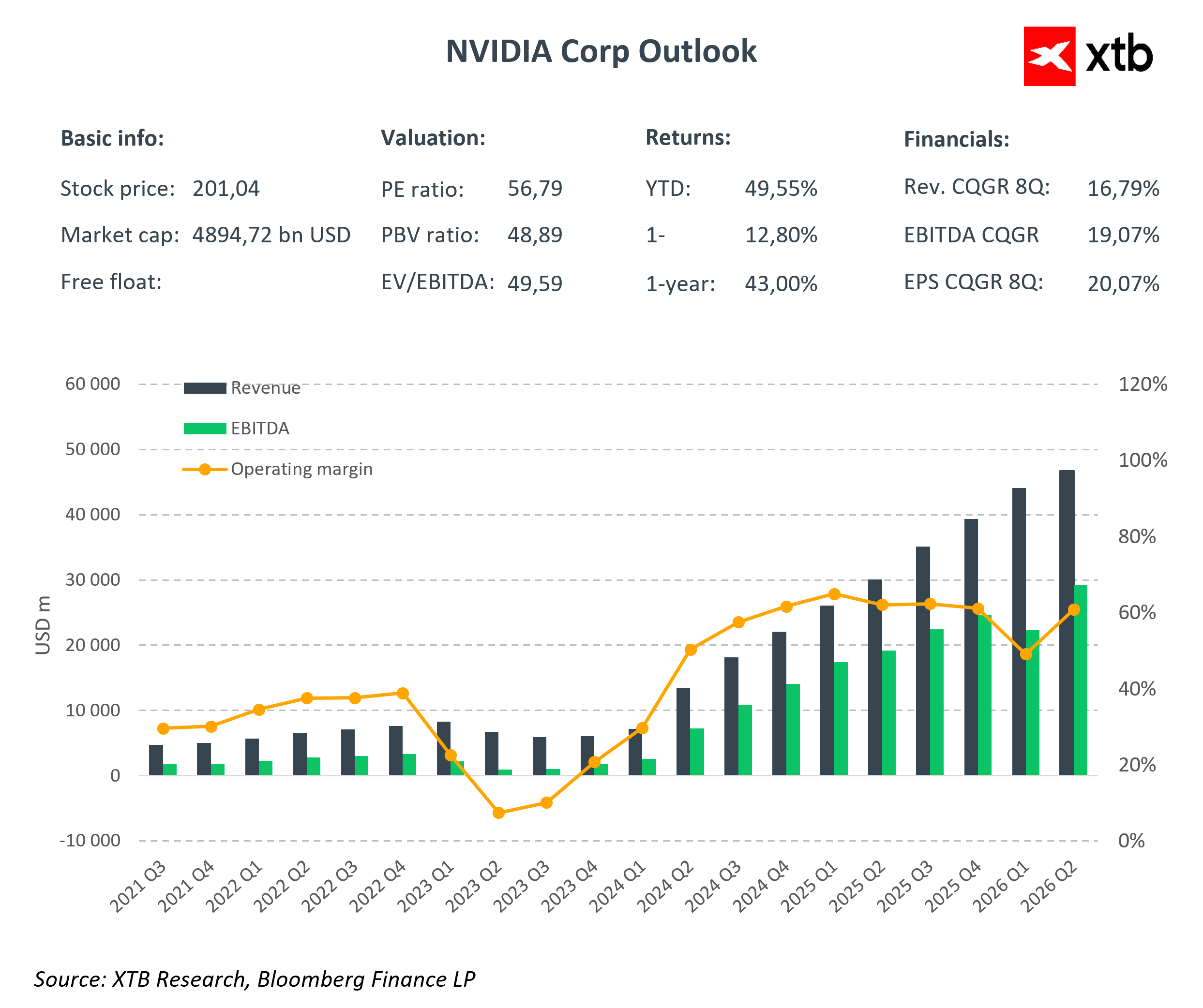

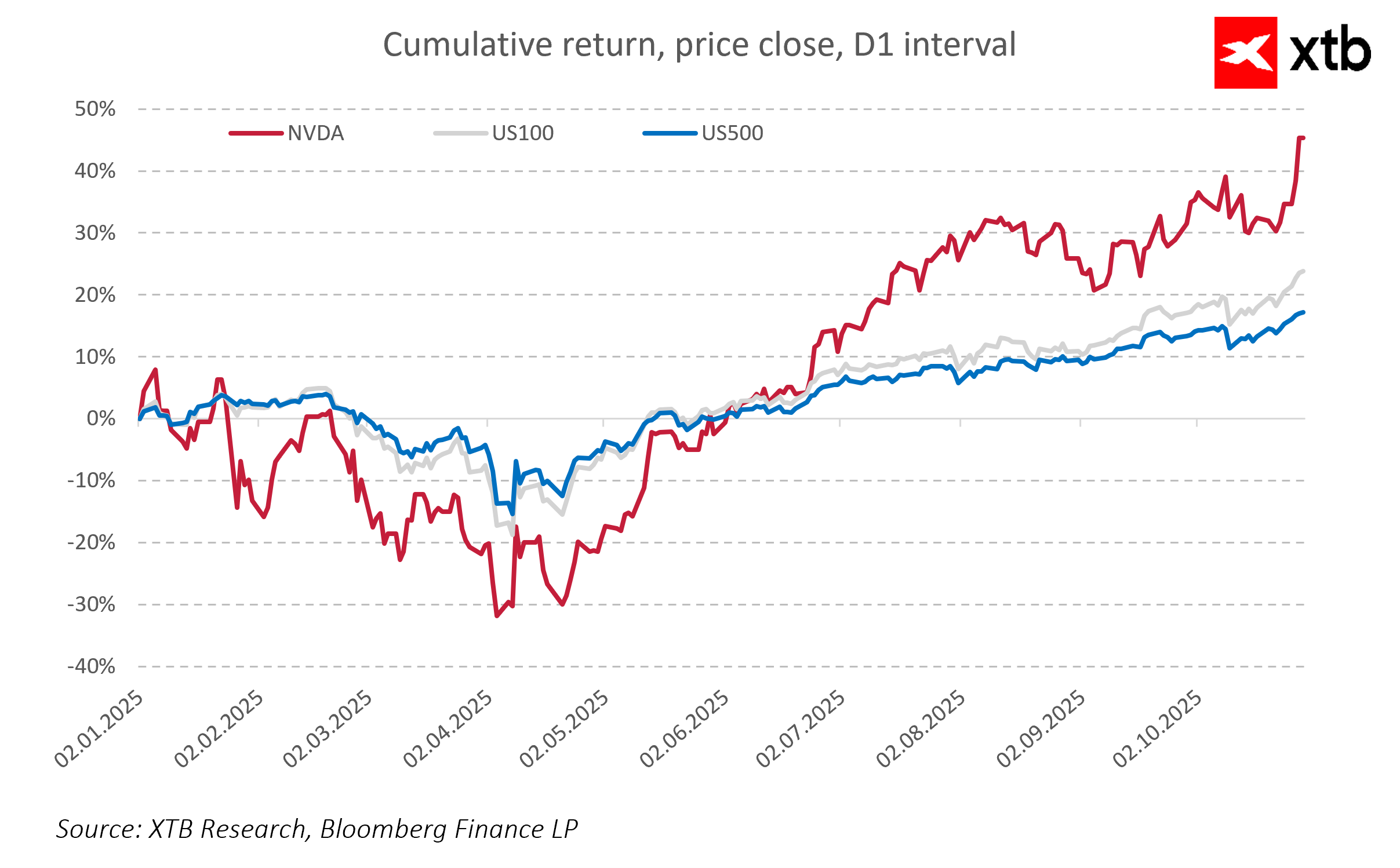

Nvidia has recorded an impressive surge in market value, approaching the $5 trillion mark and solidifying its position among the world’s most valuable companies. In recent days, the company’s stock has risen by around 5 percent, significantly boosting its capitalization and reaffirming its dominance in the global artificial intelligence sector. Investors’ attention has been drawn to both Nvidia’s strong technological foundation and recent political signals that could influence the future of the AI chip market.

A key factor behind this rally was the statement from U.S. President Donald Trump, who announced planned talks with Chinese leader Xi Jinping regarding the export of Nvidia’s Blackwell AI processors. The comments sparked optimism about a potential easing of U.S. export restrictions on China, which could open a vast and strategic market for the company. Such a development would mark a major breakthrough in the technological relations between the world’s two largest economies and could significantly impact the global semiconductor industry.

Nvidia’s rising valuation also stems from the growing demand for its advanced technologies. The company reported a substantial number of orders for its AI processors, with total bookings estimated in the hundreds of billions of dollars. At the same time, Nvidia continues to expand its research initiatives and partnerships, including collaboration with the U.S. Department of Energy on the construction of supercomputers powered by its latest Blackwell chips. This broad range of projects demonstrates that Nvidia is not only responding to market demand but actively shaping the direction of global technological development.

The combination of favorable geopolitical factors, strong business fundamentals, and innovative projects places Nvidia in an exceptionally strong position. A potential relaxation of export restrictions between the U.S. and China could further enhance its dominance in the semiconductor and AI industries. All signs suggest that Nvidia will maintain its competitive edge and remain one of the key players driving the growth of the global digital economy in the years ahead.

US commits to invest $80 billion in nuclear energy 🗽Cameco surges 20% amid Westinghouse deal

BREAKING: Sharp drop in US oil inventories 📌

Alphabet 3Q25 preview - what can we expect?

BREAKING: Bank of Canada cuts rates by 25 bp ✂️

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.