- Rates remain unchanged

- Global uncertainty persists

- Risk became more balanced

- Inflation remains within the target, but the outlook is uncertain

- ECB remains in "good place"

- Labor market and economy remains strong despite slow growth

- Rates remain unchanged

- Global uncertainty persists

- Risk became more balanced

- Inflation remains within the target, but the outlook is uncertain

- ECB remains in "good place"

- Labor market and economy remains strong despite slow growth

ECB Governing Committee has outlined monetary council views regarding the economy during a press conference:

- Chairman reassures that European economy and labor market remains strong despite tribulations

- European companies have increased their investments in IT infrastructure, software and digitalizations

- Infrastructural and industrial investments related to defense industry and armed forces are boosting economy but might increase inflation

- "Households keep saving unusually large portions of their income"

- Long term inflation expectations stay around 2%, but outlook is "uncertain"

- Tariffs, geopolitical tensions, trade disruptions main one of the primary threats to growth and are projected to remain

- Additionally, the importance of expansions and strengthening the Euro Area as well as European financial system was reiterated

- Credit conditions for business have moderately tightened

- Food inflation is easing, but energy inflation persist for longer than expected

- ECB is in "a good place" but that place is not "fixed"

- AI impact on EU job markets is "to be seen"

- Monetary transition is not hindered

- Risks to EU banking system is negligible and profits are stable

- Risks to growth are now more balanced and the range has narrowed (upsides and downsides are now more equal and both are less severe)

It was reassured repeatedly that ECB maintains reactive, data driven policy. By which, investors most likely are meant to not expect further rate cuts not justified by a substantial decline in economic growth. During the question's session, ECB officials avoided direct answers regarding whenever hikes are equally likely as cuts. By that, officials likely wanted to prevent creating disrupting carefully created inflation expectations.

ECB maintains its commitment to stability first and foremost. The Governing Committee has carefully avoided creating unrealistic expectations for growth. While growth and labor market condition remains lackluster, it is good enough for ECB to focus more on addressing numerous local and global risks to European economy and financial system - much more severe than slow growth.

The "Good place" Chairman Lagarde keeps referring to is seemingly a place in which ECB is in the best possible position to address realized risks without depriving itself of opportunities to exploit more favorable conditions for growth.

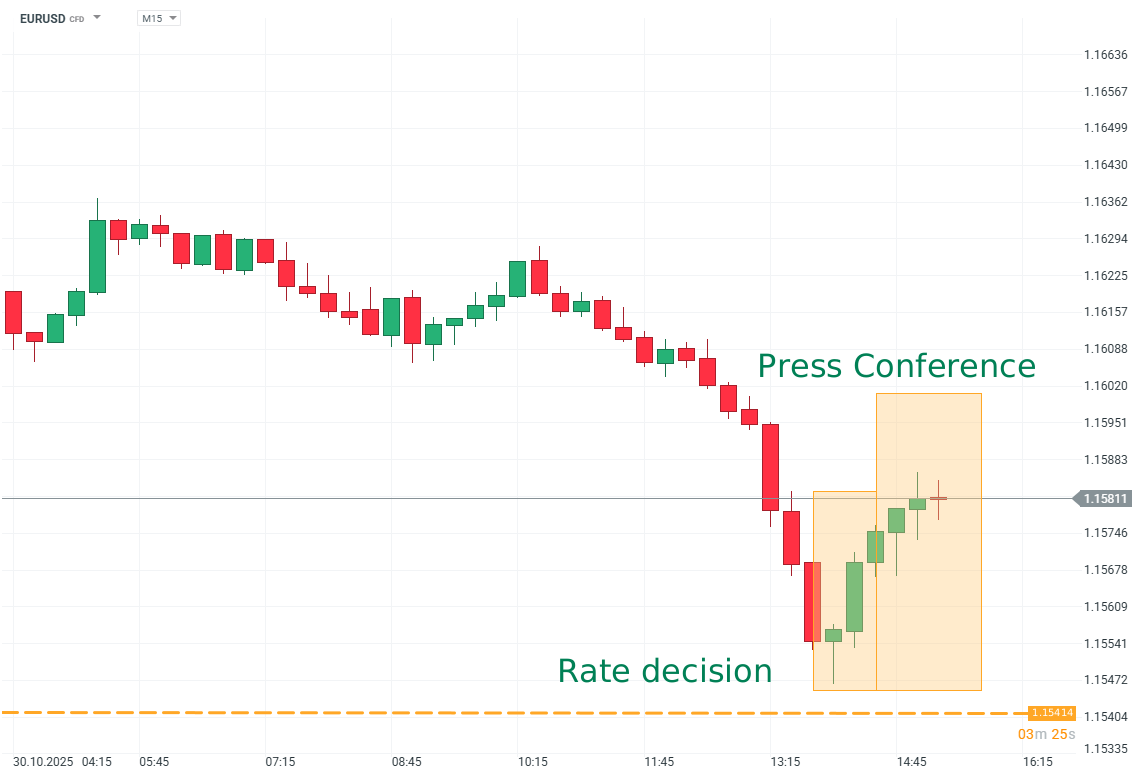

EURUSD (M15)

Source: xStation5

Euro erases some of its earlier declines after rates decision and press conference.

Chart of the day - Soybean (30.10.2025)

Morning wrap (30.10.2025)

🛢️WTI Crude Rises Over 2%

US Defense Industry Preview - Has it reached its peak?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.